Identification and Estimation of Continuous-Time Dynamic Discrete Choice Games

Jason R. Blevins.

The Ohio State University, Department of Economics

Working Paper.

Availability:

- Working Paper (November 4, 2025)

- Slides (September 30, 2025)

- Replication Files

- arXiv (updated November 4, 2025)

Abstract.

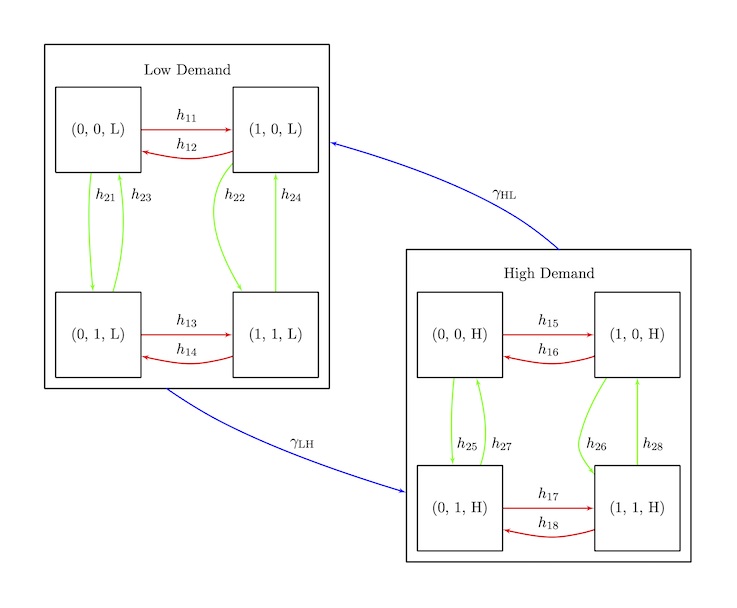

This paper considers the theoretical, computational, and econometric properties of continuous time dynamic discrete choice games with stochastically sequential moves, introduced by Arcidiacono, Bayer, Blevins, and Ellickson (2016, Review of Economic Studies). We consider identification of the rate of move arrivals, which was assumed to be known in previous work, as well as a generalized version with heterogeneous move arrival rates. We re-establish conditions for existence of a Markov perfect equilibrium in the generalized model and consider identification of the model primitives with only discrete time data sampled at fixed intervals. Three foundational example models are considered: a single agent renewal model, a dynamic entry and exit model, and a quality ladder model. Through these examples we examine the computational and statistical properties of estimators via Monte Carlo experiments and an empirical example using data from Rust (1987, Econometrica). The experiments show how parameter estimates behave when moving from continuous time data to discrete time data of decreasing frequency and the computational feasibility as the number of firms grows. The empirical example highlights the impact of allowing decision rates to vary.

Keywords: Continuous time, Markov decision processes, dynamic discrete choice, dynamic games, identification.

JEL Classification: C13, C35, C62, C73.

BibTeX Record:

@TechReport{blevins-2025,

author = {Jason R. Blevins},

title = {Identification and Estimation of Continuous-Time

Dynamic Discrete Choice Games},

type = {Working Paper},

institution = {The Ohio State University},

year = 2025

}